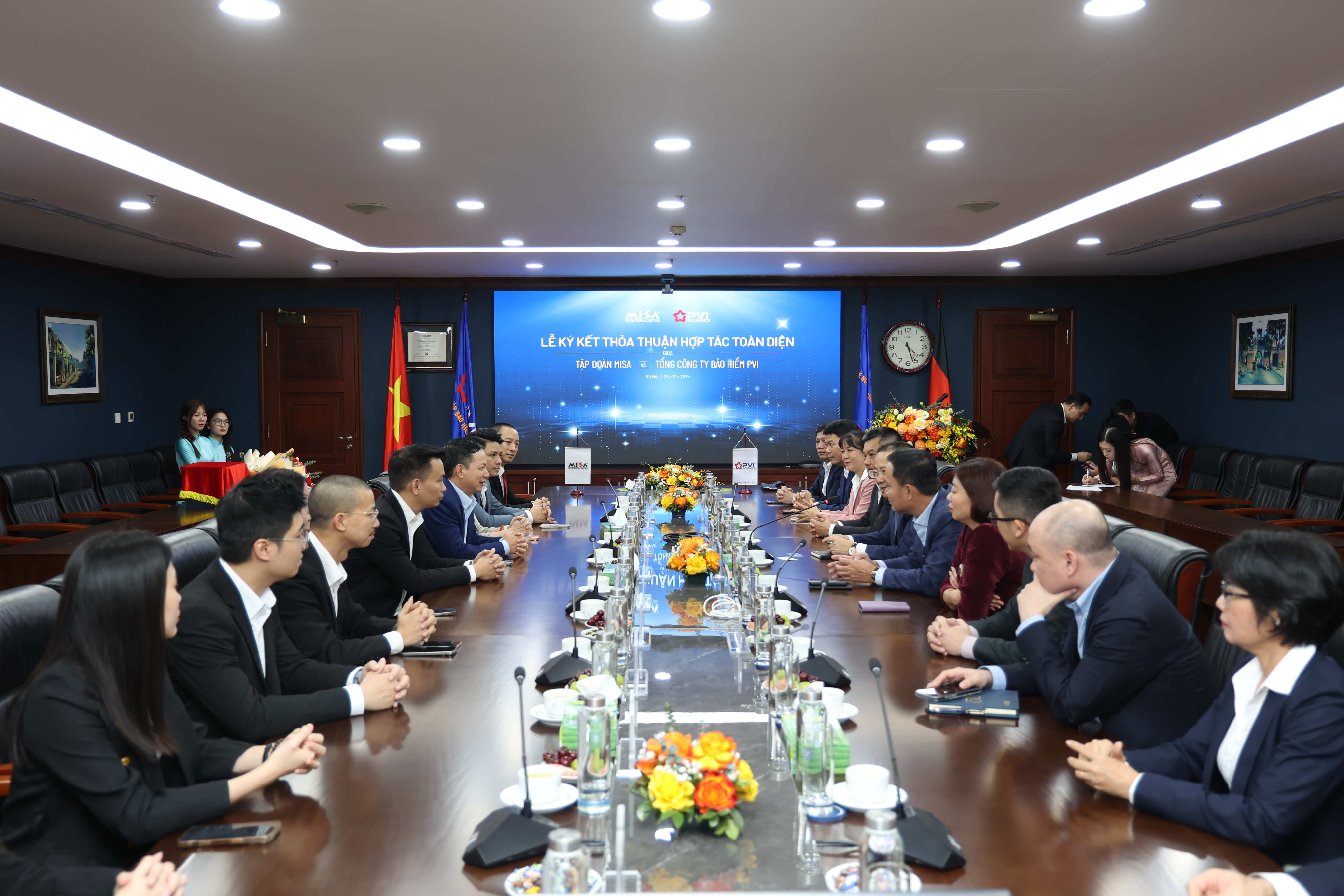

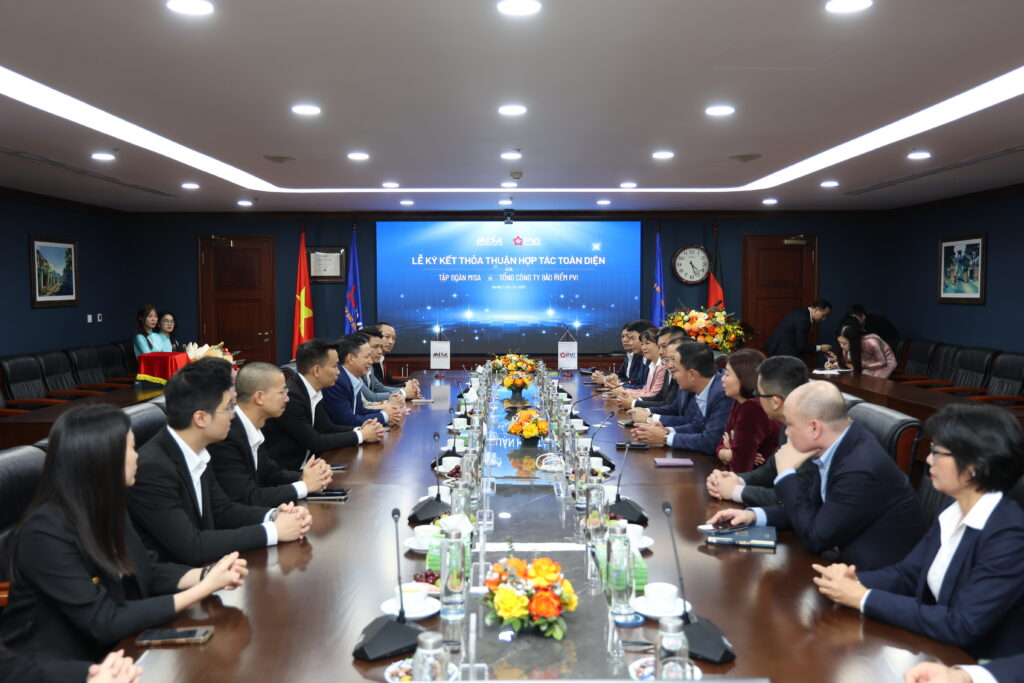

On December 25, 2025, MISA Group (MISA) and PVI Insurance Corporation (PVI Insurance) officially signed a strategic cooperation agreement, marking an important milestone in connecting digital technology with the insurance–financial sector, with the goal of serving businesses and citizens in a more convenient, transparent, and sustainable manner.

Through this cooperation, MISA and PVI Insurance will jointly deploy non-life insurance services integrated directly on the MISA Insurance digital platform. This platform is seamlessly connected with MISA’s sales, accounting, and e-invoicing solutions, enabling MISA customers to purchase insurance 100% online directly on the software. As a result, processes are significantly streamlined, helping customers minimize procedures, save time, and reduce costs.

In addition to rolling out online non-life insurance solutions, MISA and PVI Insurance will also cooperate to implement Social Insurance (SI) collection services directly on MISA’s digital platform. Under new regulations effective from July 1, 2025, small businesses and household business owners are required to participate in social insurance contributions for employees. The collaboration between the two parties will support these groups in making SI contributions conveniently and efficiently, thereby helping to expand social insurance coverage among small enterprises, household businesses, and employees.

Integrating non-life insurance services and SI collection into MISA’s digital platform simplifies the process of selecting and registering for insurance, enables fast payments, and allows real-time tracking of transaction history and status—ultimately saving time for both businesses and individuals. This cooperation clearly demonstrates the social responsibility and community commitment of both MISA and PVI Insurance in ensuring social security and promoting sustainable economic development.

Speaking at the signing ceremony, Mr. Nguyen Xuan Hoang, Vice Chairman of MISA, stated:

“This is a strategic partnership that enables MISA and PVI Insurance to expand the utility ecosystem for customers of both sides, moving toward the integration of diverse services such as motor, home, factory insurance, and social insurance collection. Through this, we aim to deliver seamless experiences and create long-term sustainable value for customers.”

Ms. Nguyen Thi Ngoan, Chief Financial Officer of MISA and Chief Executive Officer of JETPAY (a MISA member company), commented:

“MISA’s strategic cooperation with PVI Insurance is an important step in our financial–insurance ecosystem digitalization strategy, with customer experience at the core. MISA believes that the combination of MISA’s technological capabilities and PVI’s insurance expertise and credibility will help mitigate risks for customers and contribute to shaping and developing Vietnam’s digital economy.”

Sharing the same customer-centric orientation, Mr. Pham Anh Duc, Chief Executive Officer of PVI Insurance, said:

“Cooperating with MISA not only helps PVI Insurance expand customer access through modern digital platforms, but also reflects our strong commitment to accelerating digital transformation—bringing insurance and social security solutions closer to businesses and the public.”

MISA Group has more than 30 years of experience in the IT sector, currently serving nearly 400,000 enterprises and household businesses, 44,500 public administrative units, and 3.5 million individual users. MISA has developed a comprehensive digital management ecosystem with finance and accounting at its core, integrated with a convenient payment infrastructure developed by JETPAY. This creates a seamless customer experience cycle. In addition, MISA continues to expand its ecosystem by connecting with partners to flexibly meet the diverse needs of businesses and users.

PVI Insurance is the leading non-life insurer in Vietnam, possessing strong financial capacity, deep professional expertise, and a nationwide service network. In recent years, PVI Insurance has consistently been recognized with prestigious domestic and international awards, notably winning “General Insurer of the Year” and “Underwriting Initiative of the Year” at the InsuranceAsia News (IAN) Awards for Excellence 2025. These awards honor insurers with comprehensive product portfolios, outstanding claims networks, effective governance, and a development strategy closely aligned with digital transformation

The signing ceremony between MISA and PVI Insurance represents a significant milestone, opening a new phase of in-depth cooperation between a leading Vietnamese technology enterprise and a reputable non-life insurer—united by a shared vision of customer-centricity, technology-driven development, and social value creation. Looking ahead, MISA and PVI Insurance expect to further explore and expand areas of cooperation to unlock greater potential and enhance customer experience.